Fox News Ratings Earthquake: Unprecedented Dominance Amid Subtle Cracks in the Empire

The latest Nielsen numbers for Q2 2025 reveal an extraordinary milestone in cable history: Fox News not only leads but overwhelms the competition, capturing 14 of the 15 most-watched programs. Yet beneath this dominance lies a paradox—overall viewership is slightly down from the previous quarter. This article explores the factors fueling Fox’s supremacy, the cracks that hint at shifting media habits, and the lone outsider breaking into Fox’s near-total monopoly.

A Historic Sweep

Fox News has long been a ratings powerhouse, but Q2 2025 marks a watershed. Fourteen of the top fifteen shows in cable news belong to Fox, spanning every major time slot:

Greg Gutfeld’s late-night show continues to defy industry expectations, redefining what post-11pm programming can achieve.

Jesse Watters’ primetime slot harnesses a blend of viral soundbites, cultural combativeness, and polished production.

The Five maintains its group-discussion dynamism, appealing to both core conservatives and casual channel-surfers.

Together, these programs create an unbroken wall of Fox-branded dominance—something no cable network in history has previously achieved.

Turning News Into Phenomenon

The key to Fox’s success is not merely political alignment but entertainment alchemy. Executives have mastered the art of framing news as spectacle—an addictive mix of outrage, humor, and familiarity. Gutfeld, in particular, demonstrates how Fox leverages personality-driven programming to carve out audiences that other networks have written off.

This shift reflects a broader transformation: cable news, once defined by anchors, is now driven by hosts who function like pop culture brands. Ratings gold comes not from sober analysis but from moments that “go viral” on social platforms.

The Paradox of Decline Amid Growth

But the data isn’t without wrinkles. Compared to Q1 2025, overall viewership dipped slightly, raising questions about cable’s long-term ceiling. Year-over-year growth remains strong, but the quarterly drop suggests that even Fox, at the peak of its dominance, is not immune to broader industry headwinds:

Cord-cutting: Streaming continues to siphon younger viewers.

Fragmentation: Independent digital creators and podcasts erode appointment-viewing habits.

Fatigue factor: Audiences increasingly oscillate between binge engagement and total disengagement from news.

Fox’s empire is vast—but like all media empires, it rests on an audience base that is both loyal and fickle.

The Outsider Cracking the Wall

Who claimed the one non-Fox slot in the top 15? According to Nielsen, it was MSNBC’s Rachel Maddow, whose once-weekly program continues to command loyalty and cultural relevance. Maddow’s ability to translate complex narratives into accessible, emotionally resonant arcs provides a sharp counterpoint to Fox’s high-volume ecosystem. Her presence is a reminder that while Fox dominates by breadth, rivals can still compete through depth.

Implications for the Media Landscape

Fox’s Q2 triumph underscores several deeper shifts:

Cable is consolidating into personality franchises, not journalistic institutions.

Ratings dominance does not insulate networks from structural decline.

Competition now plays out across platforms, not just between cable channels.

For Fox, the challenge will be maintaining momentum while navigating industry disruption. For rivals, the task is finding ways to puncture Fox’s cultural dominance with alternative storytelling modes.

Conclusion: Dominance with an Expiration Date?

Fox News has achieved something unprecedented: near-total control of cable news ratings. Yet dominance today is no guarantee of relevance tomorrow. The slight dip from Q1, the persistence of outsider challengers like Maddow, and the ongoing march of digital disruption suggest that even this media empire must evolve—or risk becoming a victim of its own success.

News

Judicial Earthquake: Cassie’s Testimony Drags Diddy Down the Abyss — From Entertainment Mogul to Man Facing 20 Years Behind Bars!

The empire of Sean “Diddy” Combs was built on a foundation of untouchable cool. For over three decades, he wasn’t…

Three Decades Buried — Eminem’s 1993 Secret Box Unearthed After 30 Years, Revealing Mysteries Fans Never Expected!

For years, Marshall Mathers has built his career on words — brutal, beautiful, unflinching words. But what he revealed last…

Minneapolis Grieves: After a School Shooting Claims Mother and Daughter, a 5-Year-Old’s Haunting Question Echoes Through a City in Shock

The shooting unfolded on the morning of August 27, when chaos tore through a Minneapolis elementary school. By the time…

The crowd came for a show — but Eminem delivered a shocking confession and a reunion that left Detroit speechless. On stage, the Rap God didn’t perform; he revealed the untold story of the woman who saved his life long before the world knew his name.

For years, Eminem has rapped about his turbulent childhood — poverty, bullying, a chaotic home with a mother battling addiction….

“Eminem Caught Devouring a Tower of Big Macs and Fries — ‘Lose Yourself in McDonald’s’ Sparks Hilarious Internet Chaos and Leaves Fans Speechless!”

From rap god to burger king Eminem has worn many titles in his career — lyrical genius, cultural provocateur, even Rap…

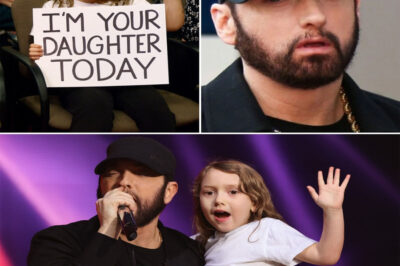

“Eminem Stunned 20,000 Fans Mid-Concert — A 10-Year-Old Girl Holds a Sign Saying ‘I’m Your Daughter Today’ and What Happens Next Leaves Everyone in Tears!”

A Pause in the Storm Eminem had just launched into “Mockingbird,” the song he wrote nearly two decades ago as a lullaby…

End of content

No more pages to load