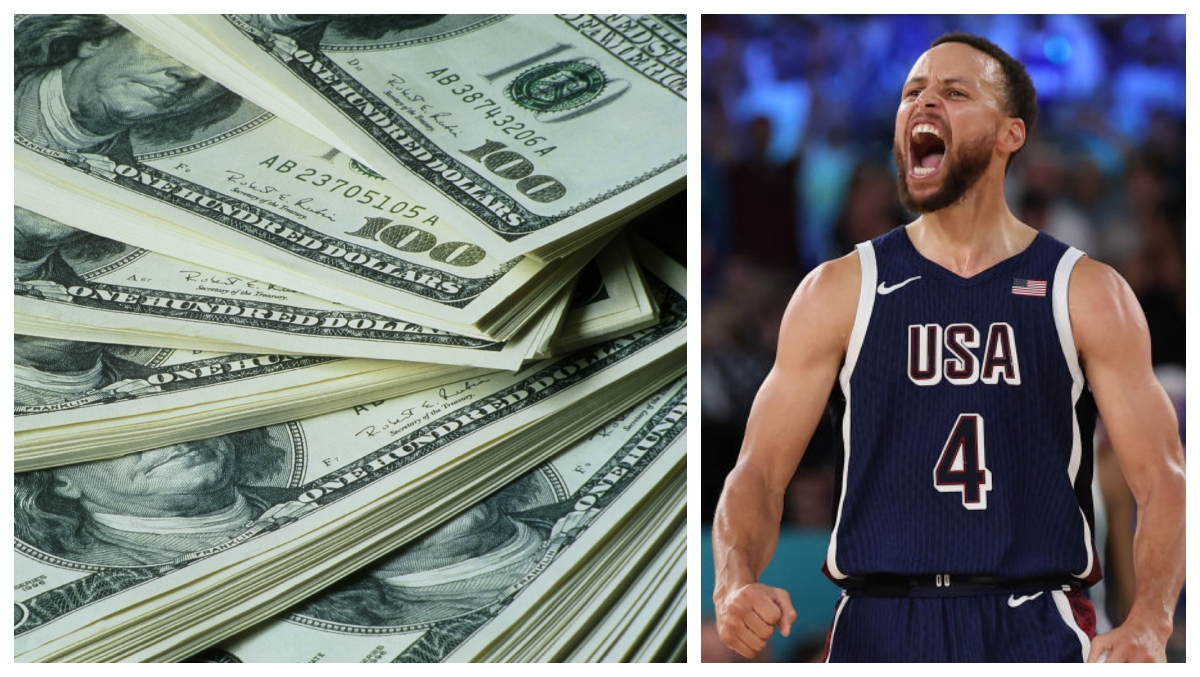

Steph Curry may earn nearly $60 million per season, but taxes take a massive bite. Between federal, California state, and jock taxes, the Warriors star likely loses more than half of his NBA salary before take-home pay.

NBA superstar Stephen Curry is not only one of the greatest shooters in basketball history — he’s also one of the league’s highest-paid athletes. For the 2025-26 season, Curry is slated to earn around $59.6 million in salary alone with the Golden State Warriors, making him the highest-paid player in the NBA.

However, elite earnings come with one of the most significant financial obligations: taxes. Between federal income tax, state income taxes, local taxes, and the so-called “jock tax” that athletes pay on money earned in states across the U.S., Curry loses a substantial portion of his income before it ever hits his bank account.

Stephen Curry’s 2025-26 Salary and Tax Bracket

In the 2025-26 NBA season, Steph Curry’s base salary with the Golden State Warriors is $59,606,817, making him the league’s top earner for the year.

At this level of income in the U.S.:

Curry is subject to the highest federal income tax bracket, which can be as high as 37%, resulting in a payable amount of $22.006 million.

He also faces state and local taxes, especially in high-tax states like California, where the Warriors play, where top rates can exceed 13 %, which is close to $5.668 million.

In addition, Curry must pay jock taxes in every state where he plays games, which allocates a portion of his income to tax authorities in each jurisdiction based on the number of days he earns money there (practices and games).

Together, these obligations can push his effective tax rate (combined federal, state, and jock taxes) well above what most Americans pay, often exceeding 50 % of his NBA salary before deductions and other costs are factored in.

Federal Income Tax — A Huge Share of Earnings

The U.S. federal income tax system is progressive, meaning higher earnings are taxed at higher rates. For top earners like Curry, the federal tax bill often consumes a significant portion of salary:

The top marginal federal rate for individuals can reach 37 %, especially at Curry’s income level.

This rate applies to the majority of his salary, meaning his federal bill alone can run into the tens of millions of dollars annually.

State and Local Taxes — Big Costs in California

California, home of the Golden State Warriors, has one of the highest state income tax rates in the country, with top marginal rates exceeding 13 %.

Even for athletes with homes in other states (like Florida or Texas, which have no state income tax), the jock tax means Curry still owes California tax on games played there.

Estimated Total Tax Burden on Stephen Curry’s Salary

According to data compiled on high-earning athletes, including NBA stars like Curry, the total taxes paid by an NBA player of his earning level can easily exceed 50 % of their gross salary. For example:

A top NBA player making around $48 million was to pay about $25.2 million in combined taxes (an effective tax rate of 52.52 %).

Applying a similar rate to Curry’s near $60 million salary suggests he could be losing well over $30 million to federal, state, local, and jock taxes in a given season.

Why Tax Burdens Are So High for NBA Superstars

Several factors contribute to this massive tax burden:

Progressive federal tax brackets: Top earners pay much higher rates than average taxpayers.

High state tax for California teams: Teams in California and certain other states create higher tax obligations for players in home games.

Jock taxes across multiple states: NBA schedules mean players work across many states, all of which can levy tax on a portion of their income.

Conclusion

Stephen Curry’s massive NBA salary puts him among the highest-paid athletes in the world — but it also exposes him to extremely high tax obligations. Due to federal income tax, state tax in California, and jock taxes from games played around the U.S., Curry likely gives up well over half of his salary to taxes alone in a given season.

News

Stephen Curry and Ayesha Curry steal the spotlight on New Year’s Eve with an unbelievably sweet “couple goals” moment — just one sentence, one look, but enough to make fans believe that behind the lavish party lies a silent promise opening a new chapter full of magic for the Curry family.

“More memories, more magic” – Stephen Curry and Ayesha Curry steals limelight with adorable couple goal moment at New Year’s…

AWKWARD MOMENT OF A LEGEND: Michael Jordan caught in an “unmissable” moment on a luxury yacht — the viral video shows the NBA icon’s instinctive reaction while gazing at his own wife, along with a subtle detail that has netizens both laughing and curious about the behind-the-scenes story of this rare moment.

The intense pressure of a multi-million dollar legal war against NASCAR cannot stop Michael Jordan from proving he is still…

Natalija Jokic REVEALS the SHOCKING SECRET that keeps Nikola Jokic IMMUNE to all the scrutiny and pitfalls of the MOST EXPENSIVE STAR on the planet

In the modern era of professional sports, the weight of a multi-million dollar contract often acts as a double-edged sword. For most…

Natalija Jokic REVEALS the SHOCKING SECRET that keeps Nikola Jokic IMMUNE to all the scrutiny and pitfalls of the MOST EXPENSIVE STAR on the planet

In the modern era of professional sports, the weight of a multi-million dollar contract often acts as a double-edged sword. For most…

“My child was in agony, yet the teammates stood by indifferent… Nikolina Jokić angrily spoke out about Nikola collapsing on the court, shocking the NBA.”

The world of professional basketball is no stranger to intense moments that can shock fans and players alike. One such moment recently…

“I used to really hate basketball….” – Nikola Jokić reveals for the first time the darkest period of his career that shocked the NBA community

For years, Nikola Jokić has been viewed as one of the calmest and most composed superstars in the history of the NBA….

End of content

No more pages to load